Despite Strong Sales, Chinese Automakers Face Mounting Financial Pressure

16 April 2009

Most domestic Chinese automakers are trumpeting better-than-expected sales in the year to date. However, few would also admit to being under unprecedented financial pressure.

Unless these companies refrain from reckless expansion and carefully plan their capital outlays, some of them will have trouble staying afloat.

Due to economic woes at home and abroad, China's auto market started contracting in the third quarter of 2008.

Hit hard by slumping sales, China's leading own-brand automaker Chery Automobile Co. ran out of cash and had to rely on government-controlled banks for financing.

Several listed automakers, including Chongqing Changan Automobile Co. and Anhui Jianghuai Automobile Co., have issued warnings that profits last year may have plunged by 50-100 percent from 2007.

Yet in spite of the downturn, most of the domestics pressed ahead with capacity expansion using money borrowed from domestic banks.

Auto sales in China came back into growth after Christmas, thanks to government incentives enacted on small displacement vehicles.

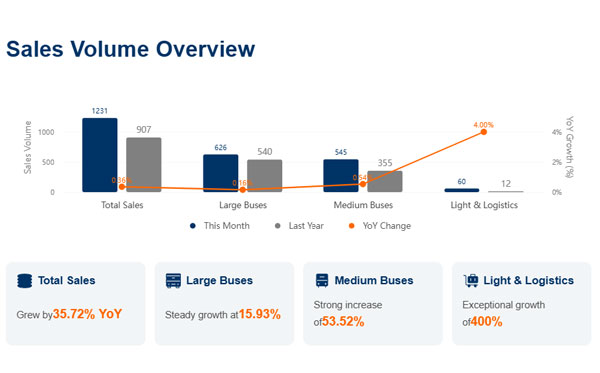

In the first quarter, passenger vehicle sales nationwide were up 7.8% from a year earlier, according to China Association of Automobile Manufacturers (CAAM).

Chery sold more than 100,000 cars in the period, achieving half of the sales target it had set for the entire year.

Its domestic peers like Shenyang Brilliance Jinbei Automotive Co. and Anhui Jianghuai Automobile Co. also reported strong sales growth.

Yet unit sales figures alone are misleading. Their increase has come mainly from inexpensive small cars. Because of slim margins at the bottom end of the market, the higher numbers will fail to generate enough profit to improve the financial health of domestic automakers.

According to CAAM, minivans accounted for 70.7 percent of passenger vehicles sold in the first quarter.

These vehicles are typically sold for around 50,000 yuan ($7,320) per unit with a profit margin of less than 10 percent.

In addition to lower profit margins on sales, another factor threatening the future profitability of domestic automakers is a tougher export market.

Chinese automakers used to be able to make good money this way.

Chongqing Lifan Industry Corp.'s president Yin Minshan once told me exporting a car to other developing countries would generate up to 10 times more profit that selling it domestically.

But due to the global slump, overseas demand for China-made cars has plummeted.

In the first quarter of 2009, Chinese companies only exported 61,000 vehicles, a drop of 62.1 percent year-on-year.

Domestic automakers are now scouring the world for new markets, but the sad thing is that on the export side there is not much they can do.

It will take quite a while for countries like Russia, now the largest export market for Chinese automakers, to recover economically and hence regain an appetite for imported cars.

What the domestics really should do is to focus on exploring their home market, and they should do it with caution.

Instead of ramping up new capacity and launching lots of inexpensive new models or lookalikes of international brands, they should step up efforts in brand building.

Chinese companies are well known for low-cost manufacturing. Under today's conditions, only stronger brands, not bigger volumes, can bring them wider profit margins and improve their financial health.

Source : internet

Views:2860

Tags: Chinese automakers sales financial pressure